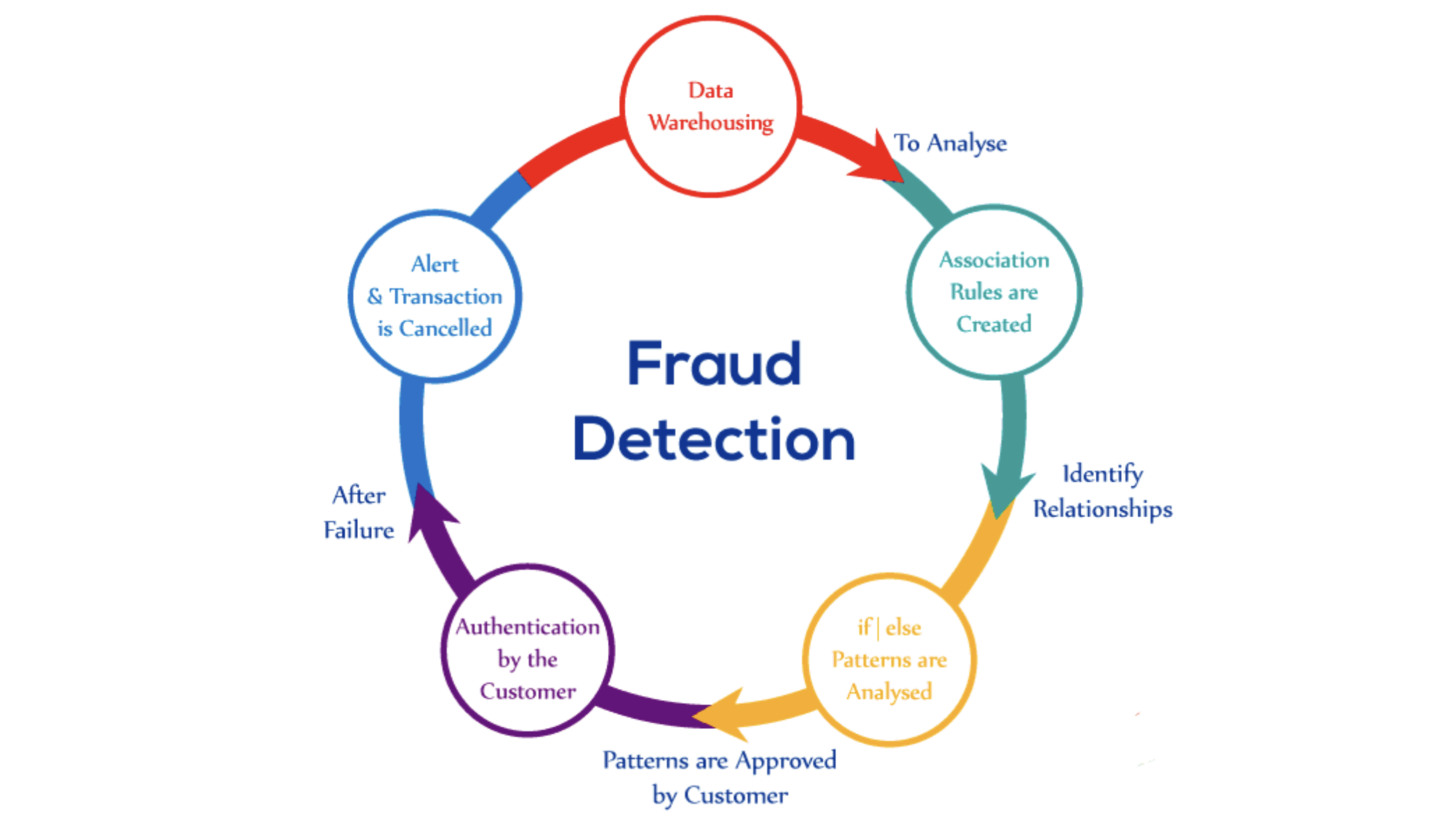

Flag unusual transactions and behaviors that might indicate fraud attempts. Analyzing historical transaction patterns per customer/customer segment, spot anomalies. Examples of fraud include credit card fraud, loan fraud fraud, on-boarding customers fraud

Business value: Reduces Fraud Loss, Gain Customer Trust, and Improve Customer Experience.

Understand the Use-case under 5 minutes

How Visa’s AI for Fraud Detection works, by spotting Anomalous Transactions while still avoiding False Declines

Watch

Article (5 minutes)

What and why banks should consider as they innovate to better serve their customers. Expands on Mobile Fraud, and ML for Real-Time Fraud Detection

ReadGet to know more Business and Technical details about the use-case (15-30 minutes)

More detailed introduction covering business and technical aspects

Article (17 minutes)

A holistic article covering different business and technical aspects related to Credit Card Fraud Detection: Types of Fraud, ML vs traditional approaches, & steps for implementing ML system

Read

White Paper (20 minutes)

This guidebook is intended to provide a high-level overview of what fraud detection and anomaly detection are, how they work and when banks can apply them

Read

Article (5 minutes)

In this article, you will learn how to mitigate the risk of banking application fraud and we will introduce our new downloadable banking fraud ROI calculator.

ReadCase studies, Organizational Aspects, Return on Investment examples

Case Study (4 minutes)

Within seven months, NG|Screener had analyzed more than five million transactions yet blocked 10 times fewer payments than its former system and achieved a better fraud detection rate

Read

Case Study (5 minutes)

DataVisor recently partnered with one of the largest banks in the U.S. to help them reduce fraudulent applications. learn how it detected an additional 30% of fraudulent accounts on top of the bank’s existing in-house detection solution.

Read

Case Study (5 minutes)

Feedzai has on boarded >7 different payment channels , processing more than half a billion events per month. This standardization has achieved the project goals where it was able to reduce fraud losses in more than $20M.

VisitMore details on the technical aspects of the use-case

Video (30 minutes)

AWS Personalize is a code-less AI service that you can use to personalize your website experience for users instead of building a recommendation engine from scratch. Video shows tech details, scenarios, and a demo

Watch

Video (20 minutes)

Details about How AWS Personalize Works, Setting it up, Preparing and Importing your Data, Creating a Solution/Campaign, and Getting Recommendations

WatchTechnical resources that will help you implement the use-case (notebooks, tutorials..)

Tutorial (1+ hours)

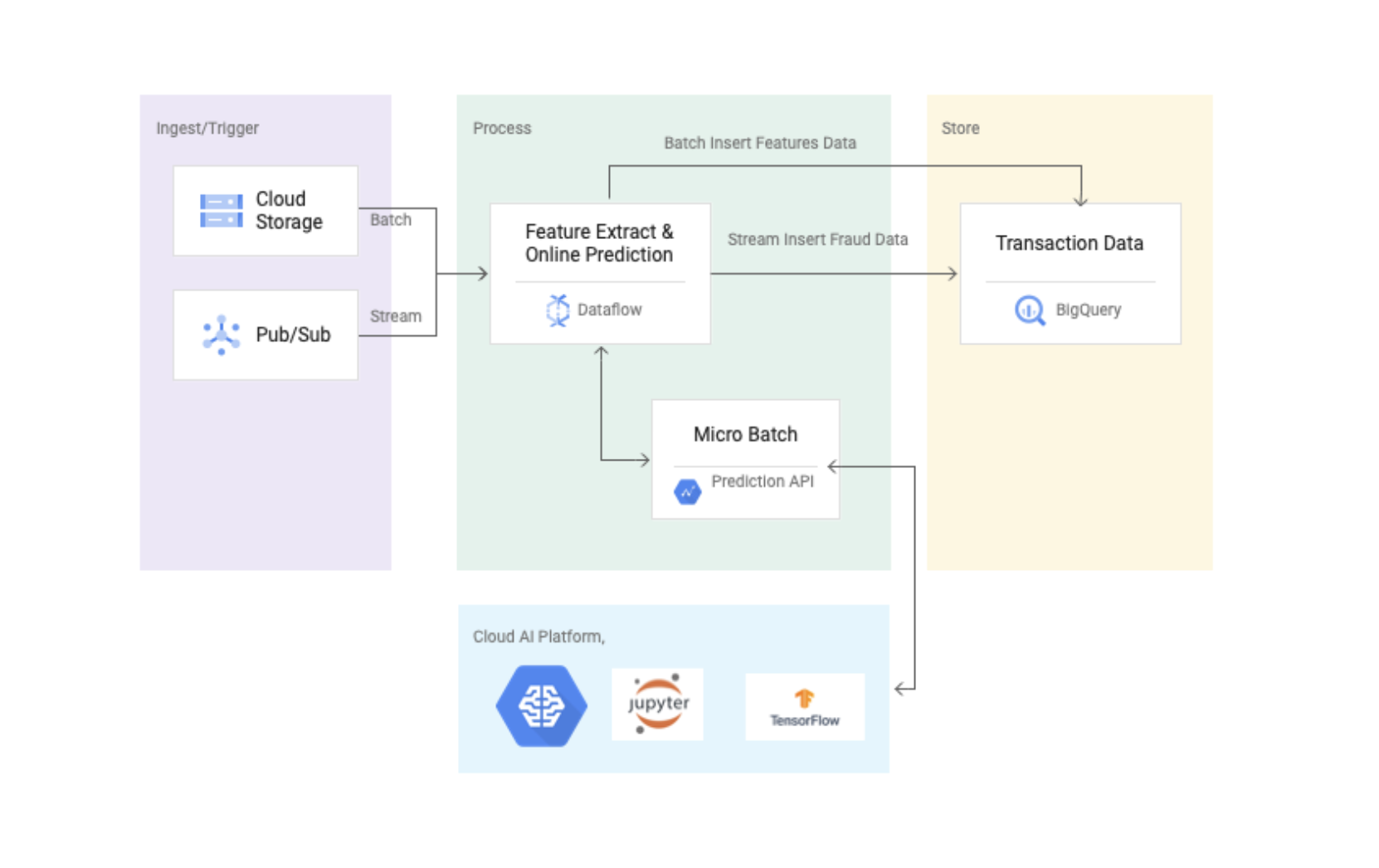

Tutorial on how to implement an anomaly detection application that identifies fraudulent transactions by using a boosted tree model using Google Cloud Platform services.

Visit

Kaggle Notebook (50 minutes)

Covers various types of recommendation engines, mathematics behind the algorithms, and building a recommendation engine from scratch using matrix factorization

Visit

Article (20 minutes)

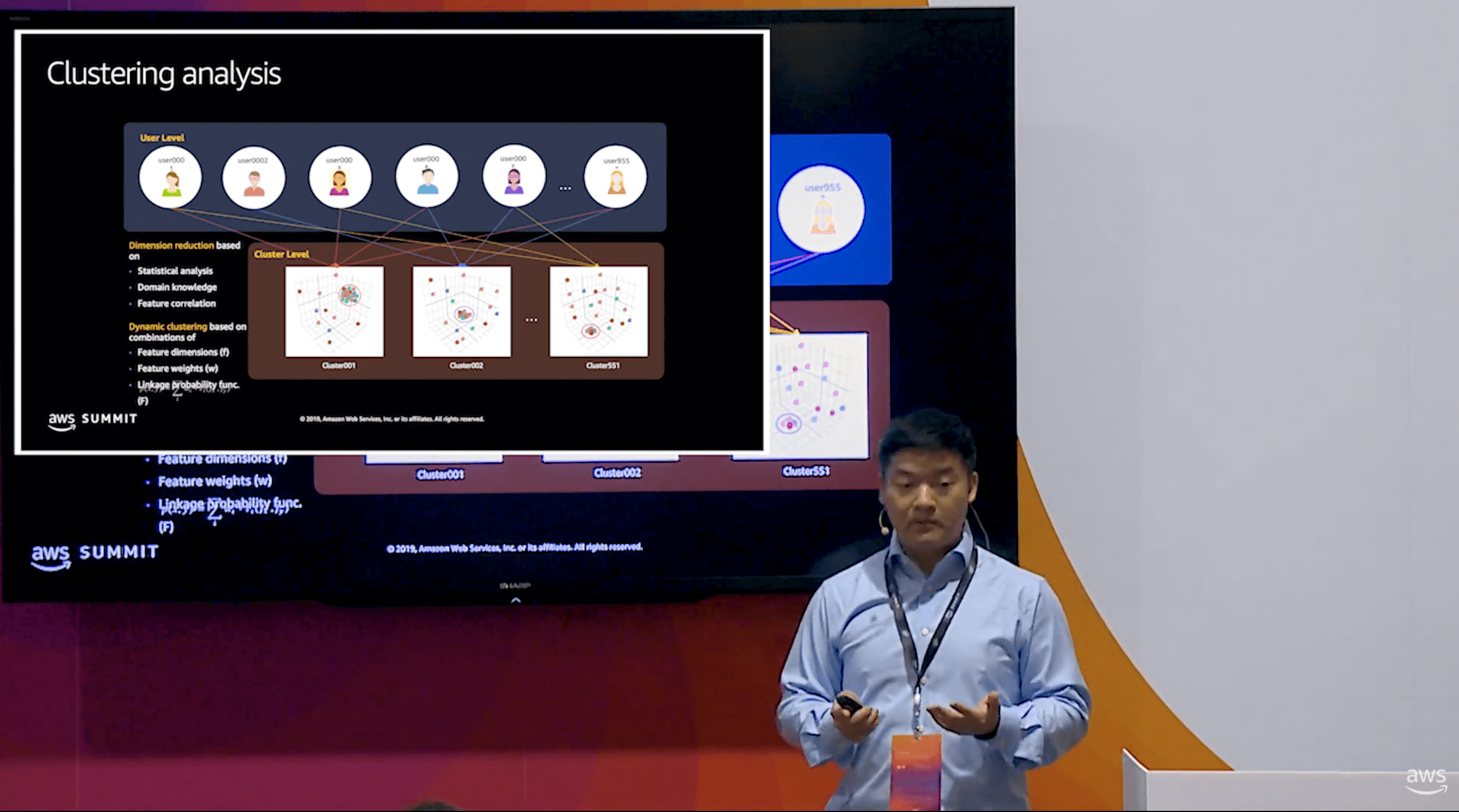

Technical details about the use of unsupervised learning for anomaly detection: the need, algorithm with underlying mathematics, model evaluation, & application with a Kaggle data set

Visit

AI Service (1.5 hours)

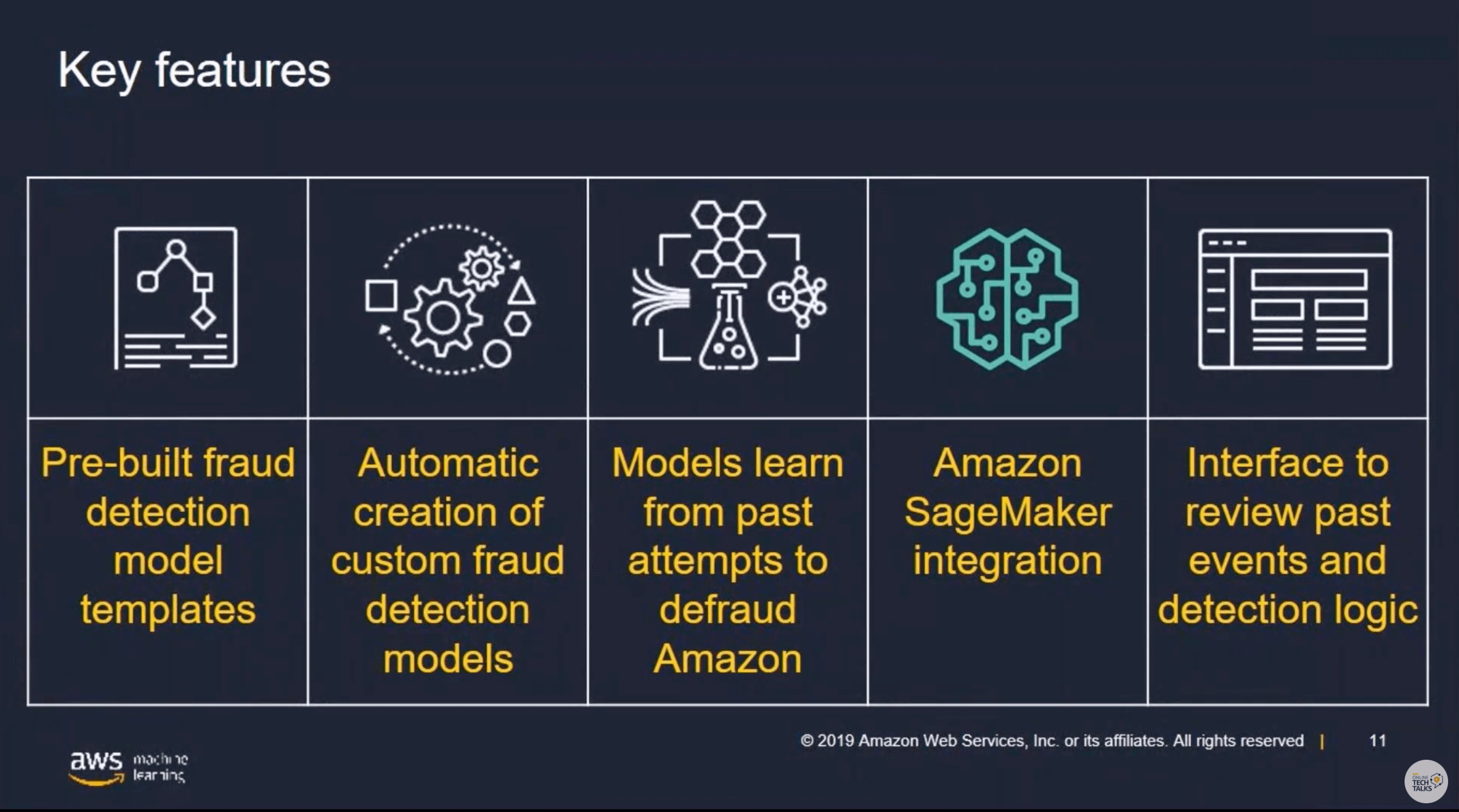

Amazon Fraud Detector is a fully managed service that helps you detect suspicious online activities such as the creation of fake accounts and online payment fraud. Docs include how it works, getting started, & a step-by-step guide

VisitData Sets you can use to build Demos, POCs, or test Algorithms

Synthetic datasets generated by the PaySim mobile money simulator

The dataset contains transactions made by credit cards in September 2013 by European cardholders.

This dataset presents transactions that occurred in two days, where we have 492 frauds out of 284,807 transactions

The data comes from Vesta’s real-world e-commerce transactions and contains a wide range of features from device type to product features (with “isFraud” as an attribute, for fraudlent transactions)

Off-the-Shelf Products using AI for Fraud Detection

Got a Question or a Resource to share with the Community? Please do!

10%- Fraud Losses

Copyright © 2025 AI Cases. All rights reserved

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.

Everything about this is SIMPLY BRILLIANT!

1- The attention to details is stunning

2- The whole thing is very well-organized, whether in terms order or sections

3- The objectives are stated clearly

4- The objectives of each section is linked to the main objective so everyone would be able to follow/keep up

5- Building a knowledge in a top-down or a flipped pyramid manner where the business knowledge base is built (with references) so that anyone (whether business or technical specialists) who will contribute in the project would know where their role lies in the big picture

6- The technical side is driven from a very well-documented business background, and that allows the technicians to be creative in finding solutions and serving the article’s objectives based on their deep understanding of the business side

7- Providing a variety of references and cases shows the urge and eagerness to help people out, and the captions under each section is very descriptive and to the point

8- The (data) sources are very rich, and being flexible with them is a huge plus

9- The interface and UX is very appealing and user friendly

10- The Discussion section is a way to go in trying to reach the best practice

Can’t wait for this thing to be officially launched and go as far as it gets.