Predict the Risk of Default per Credit Applicant (not being able to pay the loan installments on time). Assign individualized credit score based on factors including current income, employment opportunity, recent credit history,

Business value: less default losses, reduction in loan management time, better accuracy than traditional methods, and scalability

Understand the Use-case under 5 minutes

Video (2 minutes)

Disadvantages of traditional Credit Risk calculation methods, why AI is better at solving this problem by looking at thousands of data points, and how it works

Watch

Article (5 minutes)

Understanding the ML Techniques that Could Reshape Credit Risk Analysis. Case studies from Bank of England, JP Morgan Chase, BlackRock, and more

Visit

Video (3 minutes)

[Product Demo]: See how Tellius can help financial services organisations understand credit risk, make predictions using automated and transparent machine learning, and operationalize insights to decision makers using AI

WatchGet to know more Business and Technical details about the use-case (15-30 minutes)

More detailed introduction covering business and technical aspects

Article (12 minutes)

How is AI used in credit scoring? How will machine learning credit scoring models benefit your business? How can you assess credit scoring performance and continue to optimise?

Visit

Article (10 minutes)

LendIt and Brighterion collaborated on a study of lenders to ask if they were using AI to manage credit risk, what they’re using now and what their plans are for future investment. They uncover great lessons

Visit

Case Study (9 minutes)

How Kortical used AI to to predict credit default better to the point it caught 83% of bad debt not caught by traditional credit score while refusing loans to the same number of customers

VisitCase studies, Organizational Aspects, Return on Investment examples

Case Study

How an AI-based model has been performing well with a consistent average accuracy of 85-90% that has helped the client predict credit risk efficiently. The client is now able to reduce loss and add value to the business.

Read

Case Study

Explore how guided data insights helped a Top 10 financial services firm save 1000s of hrs in productivity and more than $700k in mitigated credit losses per month.

ReadMore details on the technical aspects of the use-case

White Paper (20 minutes)

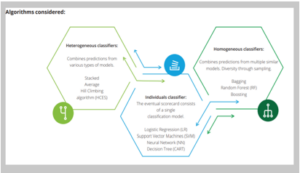

Deloitte’s technical methodologies for using Machine Learning to Predict Credit Score. Expands on Model Explainability, and the different techniques used to understand why the model is making these predictions

Visit

Video (38 minutes)

Zopa’s Credit Risk Model: data sets used, target variable, input features, the process of building different machine learning models and parameter optimization

Watch

Article (16 minutes)

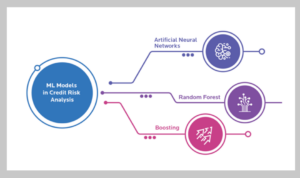

This article benchmarks three ML methods (Random Forests, Artificial Neural Networks, and Boosting) vs Moody’s RiskCalc method. It provides good examples on the features used, output comparison, and the pros and cons of each method vs the others

VisitTechnical resources that will help you implement the use-case (notebooks, tutorials..)

White Paper (1 hour)

A Step-by-Step Guide to the methodologies, processes, and data that financial services providers can use to develop new credit scoring models

Visit

Video + Github Repo

learn how you can use Amazon SageMaker to explain individual predictions from a credit application to identify bias and satisfy regulatory requirements. Explore the Dataset and Github Repo

Watch

Article + Data (11 minutes)

Utilising machine learning’s power to predict whether a borrower will default on a loan or not and to predict their probability of default. Includes code + link to dataset

Visit

Github Repo

Using automatic model tuning to determine the classification threshold that maximises the portfolio value of a lender choosing which subset of borrowers to extend credit to

VisitData Sets you can use to build Demos, POCs, or test Algorithms

Historical data are provided on 250,000 borrowers. Variables include: monthly income, age, monthly debt payments, number of open loans, number of times borrower has been 90 days or more past due, and more

This data corresponds to a set of financial transactions associated with individuals. The data has been standardized, de-trended, and anonymized. You are provided with over two hundred thousand observations and nearly 800 features.

This dataset classifies people described by a set of attributes as good or bad credit risks. Comes in two formats (one all numeric). Also comes with a cost matrix

Off-the-Shelf Products using AI for Credit Risk Scoring

Got a Question or a Resource to share with the Community? Please do!

Copyright © 2025 AI Cases. All rights reserved

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.