Predict the most suitable Insurance Policy Pricing for each customer based on different factors including their personal information, medical history, their willingness to pay, competitor pricing, and other variables. Optimize Sales Volumes and Profit Levels

Understand the Use-case under 5 minutes

Video (3 minutes)

Streamlining Insurance Pricing, from optimizing pricing strategy to rate deployment. Organizations can now predict, simulate, decide, and instantly deliver rates to market in a consistent manner, while complying with regulatory demands.

Watch

Video (2 minutes)

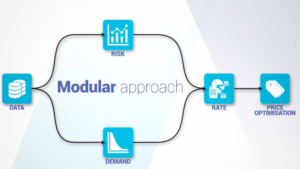

Akur8 provides an AI solution that enhances insurers’ pricing processes by automating risk and demand modeling, using Transparent AI proprietary technology.

WatchGet to know more Business and Technical details about the use-case (15-30 minutes)

More detailed introduction covering business and technical aspects

Video

Akur8 and Milliman discuss the history of insurance pricing and how it changed from routine processes into intelligent techniques, thanks to machine learning and big data.Includes different case studies with clear ROI

Watch

Article (9 minutes)

The article focuses on how data science teams use machine learning techniques to improve pricing models for insurers within their own established structures and frameworks, with some ROI examples

Visit

White Paper (9 minutes)

Expands on the challenges of a establishing a robust pricing strategy for Insurance, and why Pricing Analytics powered by Machine Learning could be the next value reservoir for insurers

ReadCase studies, Organizational Aspects, Return on Investment examples

Business Report (13 minutes)

AI-based insurance dynamic pricing models deliver a significant reduction in the time required to introduce a new pricing frameworkI. Includes different ROI figures from, and organizational recommendations to consider in the adoption journey

Read

Case Study (3 minutes)

Earnix’s Pricing solution was implemented into Warta’s legacy system, allowing the company to grow into Poland’s market-leading insurer. The company witnessed a 29% market growth between 2015 and 2018.

Read

Press Release (3 minutes)

How Akur 8 used AI to help Wefox Insurance bring Time to Market from months to a few weeks. That was done thanks to faster modeling process and higher model’s accuracy

ReadMore details on the technical aspects of the use-case

White paper (13 minutes)

Explore how the auto insurance unit of a large TIBCO customer used the TIBCO Model Ops solution to develop and operationalize a working and successful AI-powered dynamic pricing system

Read

Video (8 minutes)

Demo for building an Auto Insurance Dynamic Pricing model using TIBCO Spotfire. Demonstrates how continuous learning can productionalize your Machine Learning applications in real-time

WatchTechnical resources that will help you implement the use-case (notebooks, tutorials..)

Kaggle Notebook

A pretty comprehensive and well-explained notebook that uses different machine & deep learning algorithms to predict the adequate insurance price based on French motor claims dataset using R language.

Visit

Video (20 minutes)

The goal of this paper is to apply machine learning techniques to insurance pricing, thereby leaving the actuarial comfort zone of generalized linear models (GLMs) and generalized additive models (GAMs)

Watch

Paper (13 minutes)

No regulator is likely to blindly support a rating plan that relies on blackbox models any time soon. The paper discussed why GLMs and GAMs are generally preferred to other less-open models, and provide some thoughts on the road ahead

Read

Paper (25 minutes)

This study demonstrates how different models of regression can forecast insurance costs including Multiple Linear Regression, Generalized Additive Model, SVMs, Deep Neural Networks, and more

ReadData Sets you can use to build Demos, POCs, or test Algorithms

59,381 life insurance applications with the assigned risk rating. Each application consists of 126 features that are either continuous, discrete, or categorical(e.g. age, height, weight, BMI, family history, and more)

Kaggle Challenge + Data: Predict how often a driver will file an insurance claim in a year, the data contains risk features and claim numbers collected for 677,991 motor liability policies.

Kaggle Challenge + Data: Predict insurance costs using historical claims data including age, sex, BMI, smoking, region, and more

Off-the-Shelf Products using AI to Personalize Policy Pricing

Got a Question or a Resource to share with the Community? Please do!

Copyright © 2025 AI Cases. All rights reserved

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.