Traditional claims processing is a highly manual, time & money-consuming, and error-prone process. AI can quickly analyze claims data in different formats (photos, handwritten documents, voice memos, invoices), predict its severity, and recommend best actions. This results in increased productivity and efficiency of the claims lifecycle.

Understand the Use-case under 5 minutes

Article + Video

Making motor claims assessment effortless, fast and user friendly with Artificial Intelligence.

Visit

Article (5 minutes)

Exploring how AI can transform the Claim Processing process, specifically on four fronts: Data capture, Visual assessment, Risk management, and Payments

Read

Article (3 minutes)

Accurate predictions can help you lower your claim cost by assigning the right adjuster or making critical decisions regarding case management early in the claim’s lifecycle.

ReadGet to know more Business and Technical details about the use-case (15-30 minutes)

More detailed introduction covering business and technical aspects

Article (17 minutes)

A detailed guide describing how AI could be used to automate claims processing via: intelligent claim submission, intelligent document processing, and damage evaluation using computer vision.

Visit

Article (3 minutes)

AI empowers different steps across the Claim Processing value chain: Claims Triage, FNOL Risk Ranking, Claim Development, Attorney Involvement Prediction, Litigation Probability, Legal Expense Prediction, and more

VisitCase studies, Organizational Aspects, Return on Investment examples

Article

McKinsey estimates that in Germany alone insurers could save about 500 million Euros each year by adopting machine learning systems in healthcare insurance. The article highlights some organizational best practices for implementing AI-based claims processing

Visit

Case Study

Lemonade, the insurance company powered by artificial intelligence and behavioral economics, announced it has set a world record for the speed and ease of paying a claim: 3 seconds and zero paperwork.

VisitMore details on the technical aspects of the use-case

The solution leverages AI to examine and analyze the images, documents, and audio and video feeds submitted for a claim. It reduced the elapsed time for damage estimates from 2-3 weeks down to just a couple of days

Visit

Video (6 minutes)

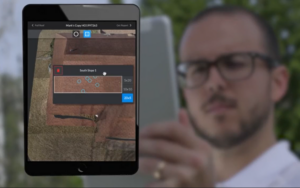

IBM provides a demo to see how insurance companies can modernize their approach to automotive claims processing. AI can automate different pieces of the workflow including Fraud Detection

Watch

Video (48 minutes)

Demonstration for an end to end workflow for a car damage claim processing (watch starting 2:27)

WatchTechnical resources that will help you implement the use-case (notebooks, tutorials..)

Notebook

Predicting the category of a claim early in the process using: Random Forests, Support Vector Machines, MLP Neural Networks and K- Nearest Neighbor Learning

Visit

Automating Property Claims processing via Item Classification and Matching. Used NLP through a multi-class classifier built on text features, and a multimodal branched deep neural network acting as a ranker for refining item matches

Visit

Paper (30 minutes)

An automated AI system that has different components to tackle each of the tasks performed during the claim process using an end-to-end pipeline for the user to upload images, visualize the predictions, and also get the estimate of the cost of repair.

Read

Article + Github Repo

Python application to automate the extraction and validation of healthcare claim documents using Amazon Textract and Amazon Comprehend Medical.

Visit

Predict what kind of claims an insurance company will get. This is implemented in python using ensemble machine learning algorithms.

Visit

Github Repo

Using a dataset from Kaggle; provided by AllState (a US-based insurance company); this notebook tries to predict the severity of claims using different machine learning techniques - so as to enhance the claims processing speed

VisitData Sets you can use to build Demos, POCs, or test Algorithms

188,318 training examples. Each row in this dataset represents an insurance claim, along with 130 attributes: 116 are categorical, and 14 are numerical features. There is a loss associated with each training example.

Off-the-Shelf Products using AI to Automate Claims Processing

Got a Question or a Resource to share with the Community? Please do!

Copyright © 2025 AI Cases. All rights reserved

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.